It’s time for the 5th and final part of the Build Better Strategies series. In part 3 we’ve discussed the development process of a model-based system, and consequently we’ll conclude the series with developing a data-mining system. The principles of data mining and machine learning have been the topic of part 4. For our short-term trading example we’ll use a deep learning algorithm, a stacked autoencoder, but it will work in the same way with many other machine learning algorithms. With today’s software tools, only about 20 lines of code are needed for a machine learning strategy. I’ll try to explain all steps in detail. Continue reading “Better Strategies 5: A Short-Term Machine Learning System”

Tag: Data mining bias

Better Strategies 4: Machine Learning

Deep Blue was the first computer that won a chess world championship. That was 1996, and it took 20 years until another program, AlphaGo, could defeat the best human Go player. Deep Blue was a model based system with hardwired chess rules. AlphaGo is a data-mining system, a deep neural network trained with thousands of Go games. Not improved hardware, but a breakthrough in software was essential for the step from beating top Chess players to beating top Go players.

In this 4th part of the mini-series we’ll look into the data mining approach for developing trading strategies. This method does not care about market mechanisms. It just scans price curves or other data sources for predictive patterns. Machine learning or “Artificial Intelligence” is not always involved in data-mining strategies. In fact the most popular – and surprisingly profitable – data mining method works without any fancy neural networks or support vector machines. Continue reading “Better Strategies 4: Machine Learning”

The Cold Blood Index

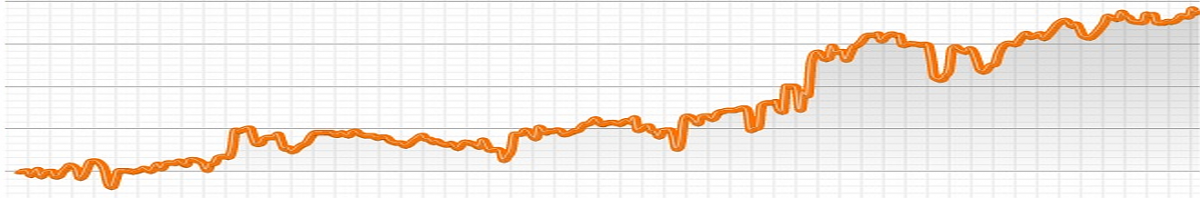

You’ve developed a new trading system. All tests produced impressive results. So you started it live. And are down by $2000 after 2 months. Or you have a strategy that worked for 2 years, but revently went into a seemingly endless drawdown. Situations are all too familiar to any algo trader. What now? Carry on in cold blood, or pull the brakes in panic?

Several reasons can cause a strategy to lose money right from the start. It can be already expired since the market inefficiency disappeared. Or the system is worthless and the test falsified by some bias that survived all reality checks. Or it’s a normal drawdown that you just have to sit out. In this article I propose an algorithm for deciding very early whether or not to abandon a system in such a situation. Continue reading “The Cold Blood Index”

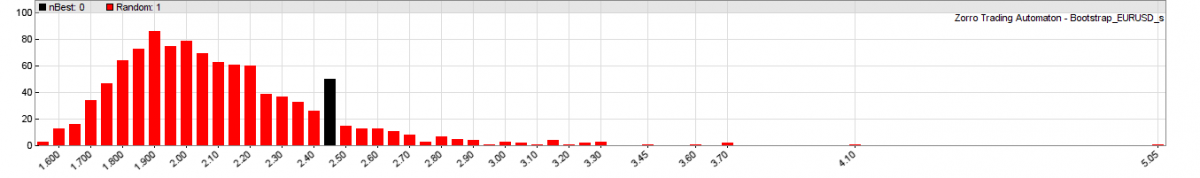

Boosting Strategies with MMI

We will now repeat our experiment with the 900 trend trading strategies, but this time with trades filtered by the Market Meanness Index. In our first experiment we found many profitable strategies, some even with high profit factors, but none of them passed White’s Reality Check. So they all would probably fail in real trading in spite of their great results in the backtest. This time we hope that the MMI improves most systems by filtering out trades in non-trending market situations. Continue reading “Boosting Strategies with MMI”

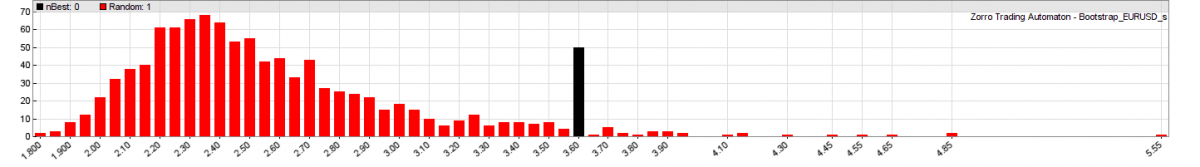

White’s Reality Check

This is the third part of the Trend Experiment article series. We now want to evaluate if the positive results from the 900 tested trend following strategies are for real, or just caused by Data Mining Bias. But what is Data Mining Bias, after all? And what is this ominous White’s Reality Check? Continue reading “White’s Reality Check”