Perry Kaufman, known for his technical indicators bible, presented in TASC 1/24 a trading strategy based on upwards and downwards gaps. For his system, he invented the Gap Momentum Indicator (GAPM). Here I’m publishing the C version of his indicator, and a simple trading system based on it. Continue reading “The Gap Momentum System”

Tag: Momentum

Build Better Strategies! Part 2: Model-Based Systems

Trading systems come in two flavors: model-based and data-mining. This article deals with model based strategies. Even when the basic algorithms are not complex, properly developing them has its difficulties and pitfalls (otherwise anyone would be doing it). A significant market inefficiency gives a system only a relatively small edge. Any little mistake can turn a winning strategy into a losing one. And you will not necessarily notice this in the backtest. Continue reading “Build Better Strategies! Part 2: Model-Based Systems”

The Market Meanness Index

This indicator can improve – sometimes even double – the profit expectancy of trend following systems. The Market Meanness Index tells whether the market is currently moving in or out of a “trending” regime. It can this way prevent losses by false signals of trend indicators. It is a purely statistical algorithm and not based on volatility, trends, or cycles of the price curve. Continue reading “The Market Meanness Index”

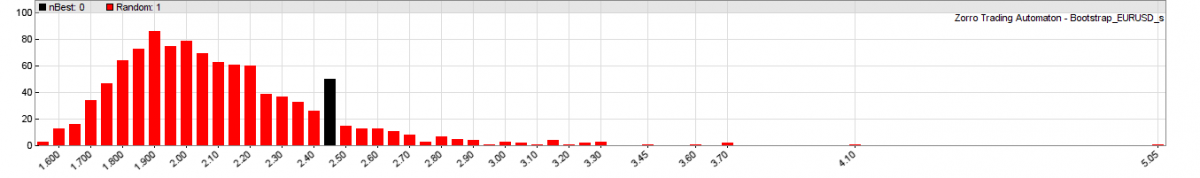

White’s Reality Check

This is the third part of the Trend Experiment article series. We now want to evaluate if the positive results from the 900 tested trend following strategies are for real, or just caused by Data Mining Bias. But what is Data Mining Bias, after all? And what is this ominous White’s Reality Check? Continue reading “White’s Reality Check”

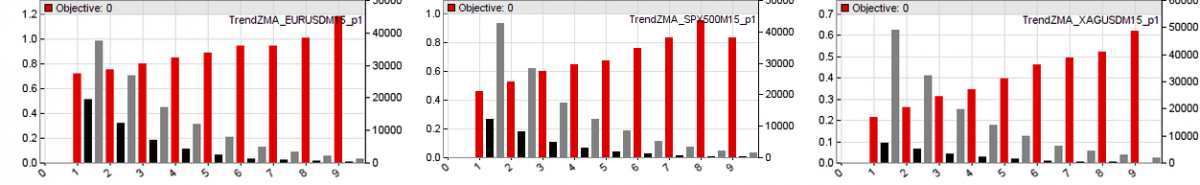

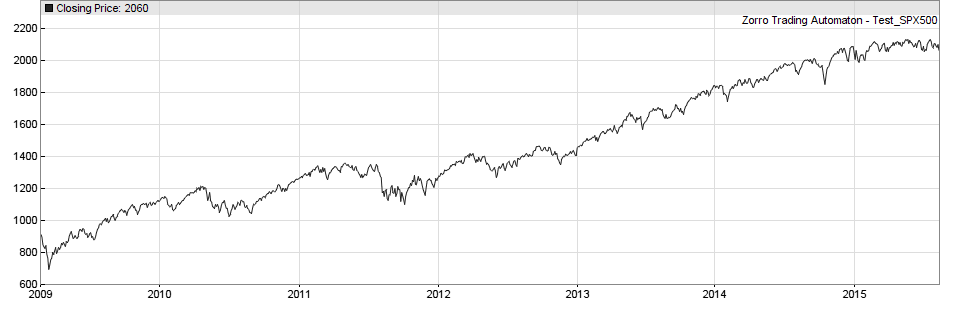

The Trend Experiment

This is the second part of the trend experiment article series, involving 900 systems and 10 different “smoothing” or “low-lag” indicators for finding out if trend really exists and can be exploited by a simple algorithmic system. When you do such an experiment, you have normally some expectations about the outcome, such as: Continue reading “The Trend Experiment”

Trend Indicators

The most common trade method is ‘going with the trend‘. While it’s not completely clear how one can go with the trend without knowing it beforehand, most traders believe that ‘trend’ exists and can be exploited. ‘Trend’ is supposed to manifest itself in price curves as a sort of momentum or inertia that continues a price movement once it started. This inertia effect does not appear in random walk curves. Continue reading “Trend Indicators”